does florida have capital gains tax on real estate

Long-term capital gains tax is a tax applied to assets held for more than a year. There is no Florida capital gains tax on individuals at the state level and no state income tax.

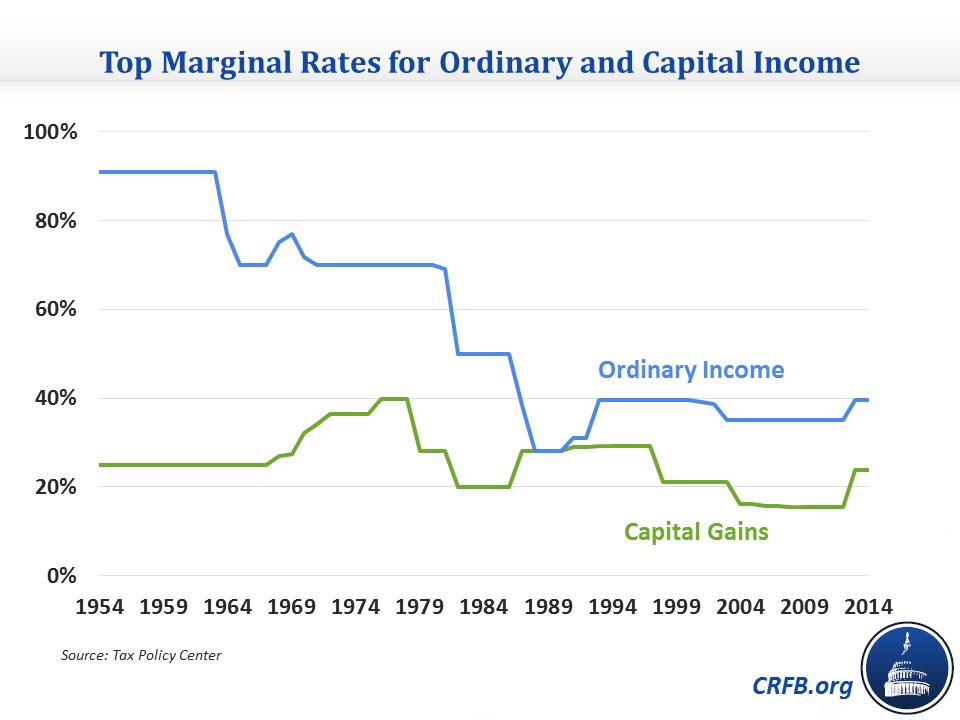

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

What You Need To Know 2022.

. Special Real Estate Exemptions for Capital Gains. The Florida income tax code piggybacks the federal income tax code for treatment of capital gains of corporations. Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt from taxation if you meet.

Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules. Capital Gains Taxes Considerations for Selling Florida Real Estate. Make sure you account for the way this.

500000 of capital gains on real estate if youre married and filing jointly. Ncome up to 40400. Make sure you account for the way this will impact your future profits which will have an impact on your capital gains tax when.

Federal long-term capital gain rates depend on your. The State of Florida does not have an income tax for. 250000 of capital gains on real estate if youre single.

Section 22013 Florida Statutes. The state of florida does not have a state income tax and it also does not have a capital gains tax regardless of your state of residency. Individuals and families must pay the following capital gains taxes.

The Three Types of Florida Real Estate Taxes. If you owned and lived in the place for two of the five years before the sale then up to. It depends on how long you owned and lived in the home before the sale and how much profit you made.

1 week ago Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt. The IRS typically allows you to exclude up to. Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or.

What is the capital gain tax for 2020. The State of Florida does not have an income tax for individuals and therefore no capital gains tax for individuals. The State of Florida does not have a state income tax and it also does not have a capital gains tax regardless of your state of residency.

The long-term capital gains tax rates are 0 percent 15. You may however be subject to capital.

Capital Gains On Home Sales What Is Capital Gains Tax On Real Estate Guaranteed Rate

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

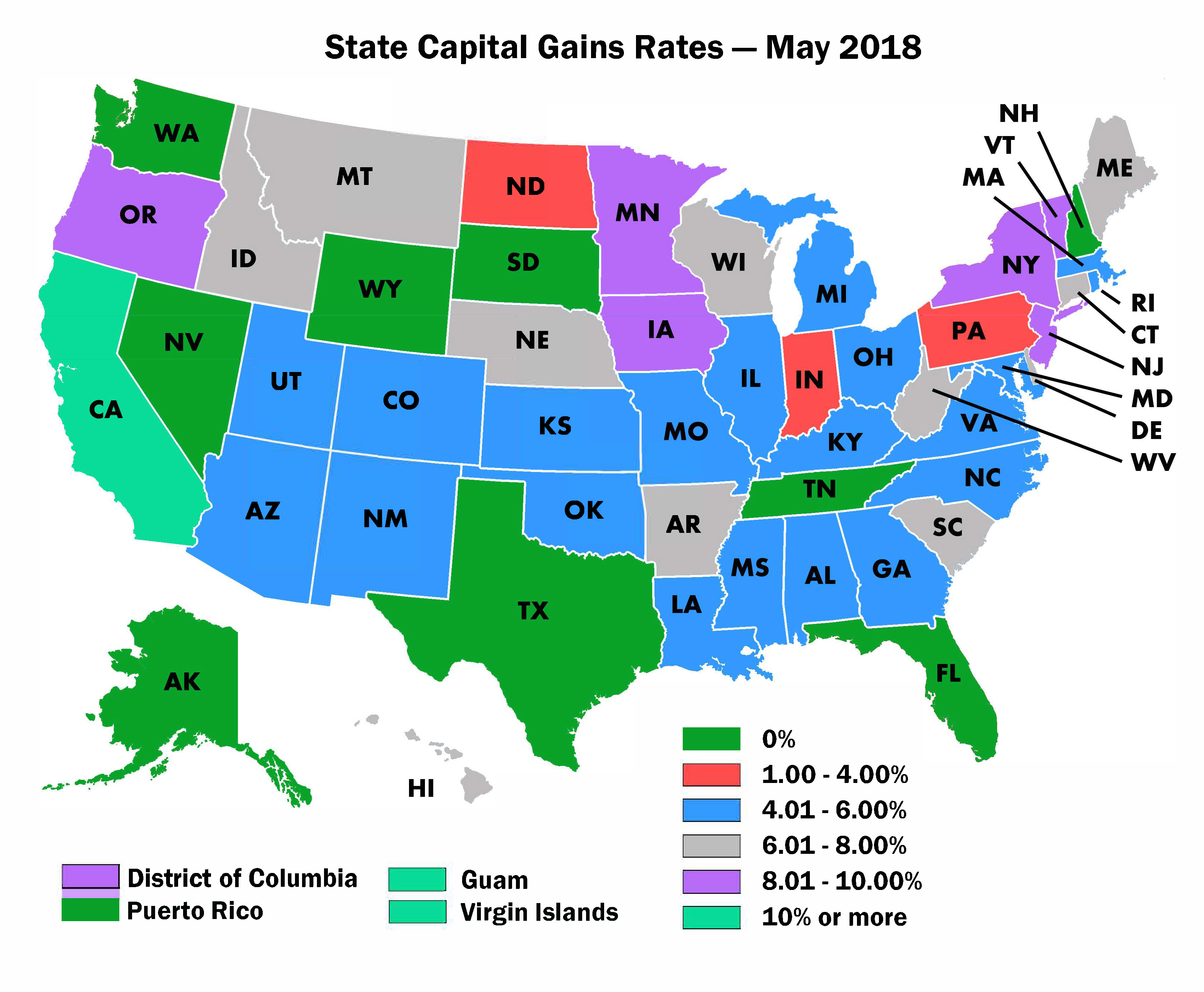

State Taxes On Capital Gains Center On Budget And Policy Priorities

How To Avoid Capital Gains Tax When Selling Your Home

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

What You Need To Know When Selling Your Primary Residence In Florida

Capital Gains Tax Rates For 2022 Vs 2021 Kiplinger

/sale-of-your-home-3193496-final-5b62092046e0fb005051ed81-5f8516d5ac044c7a811778ba3bebf510.png)

Home Sale Exclusion From Capital Gains Tax

Capital Gains Tax Calculator Real Estate 1031 Exchange

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

How To Avoid Capital Gains Tax On Real Estate Quicken Loans

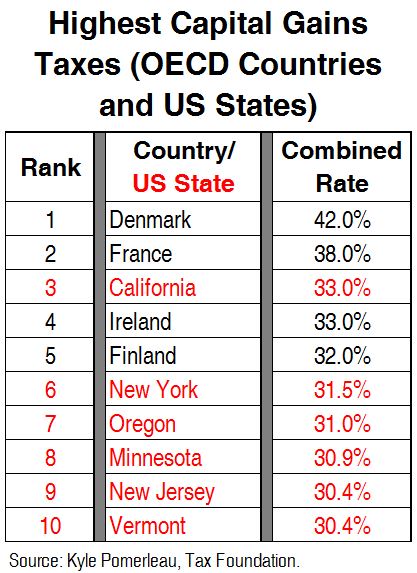

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Tax Tips For Selling A House In Florida Florida Cash Home Buyers